This market will come around again… won’t it? Well, to stay on top of markets and keep my mind off of the news and stock market, lets dig into some more comparative analysis. Fort Collins versus Greeley single family investment.

Man, about 4-5 years ago, I was talking to my investor partners about investing in Greeley and they wanted nothing to do with Greeley. These are folks who grew up in Northern Colorado and Fort Collins who only think of Greeley as a cow town. The smell of cow sh*t, well, that’s Greeley.

But not anymore. Greeley has been one of the hottest investment markets for Real Estate over the past 4-5 years. Well, had you bought in 2014, when the median price was $192,000 and the average price was $210,829, you’d be doing quite well. The median sales price in 2019 was $310,000 and the average was $324,747. Not bad, a 61% return.

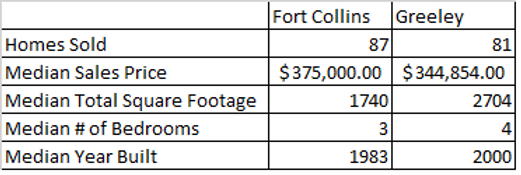

How does that compare to what you could do in Fort Collins. We are going to keep parameters the same for discussion sake. Meaning, we looked at the last 40 days of sales between $300,000 to $400,000.

Considering the median price to sell in Greeley in 2019 was only $310,000, when we put the parameters on of $300k to $430k, it pumped the median sales price up a bit. This also pumped the median age of the home up a bit. The AVERAGE age in our analysis was actually 1992. Greeley is an old community. Been around since they were first figuring out water rights.

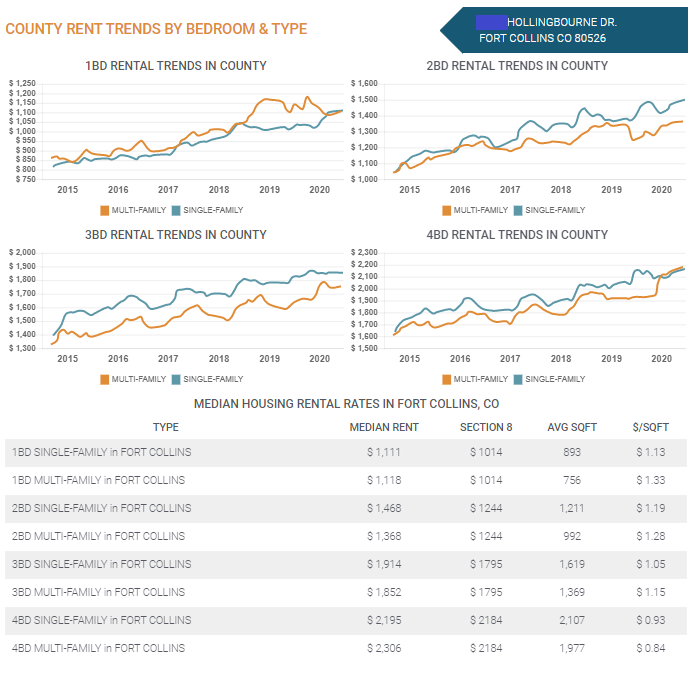

A reminder of what you can buy in Fort Collins for under $400,000 and what it could rent for:

Again, here you are buying more on preservation of capital than cash flow. For fun, what would the debt service be, if you put 25% down on a home in Fort Collins at $375,000.

Home Price: $375,000

Loan Amount: $281,250

Debt Service – 30-Year Fixed at 4.5% Interest: $1,425.00

30% Estimated Expenses on a Gross Rent Amount of $1,939: $581.70/Month

Cash Flow: ($67.70)/Month

So you are either going to need to put more money down, negotiate the price down, manage the property yourself, or buy a home for less money and try and fetch similar rents to cash flow positive.

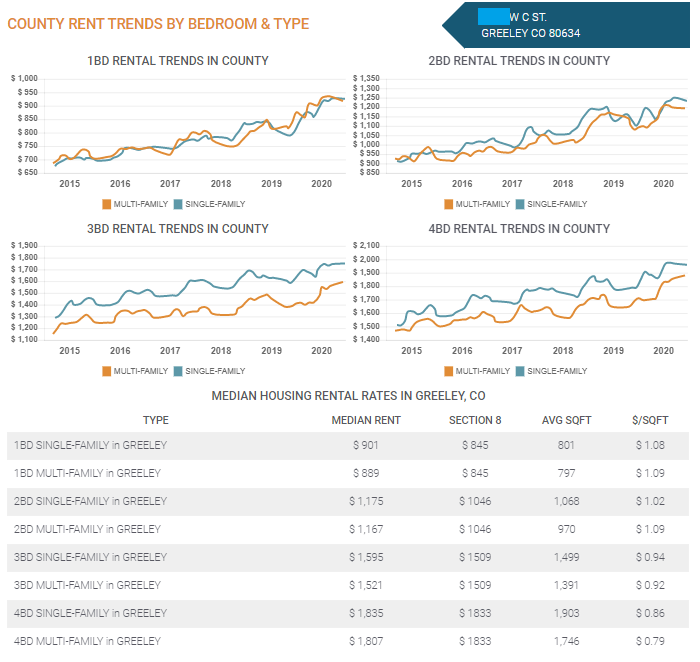

Alrighty, here is a home in Greeley for you that sold for $345,000:

Again, along with the analysis from Windsor, you are getting almost a newer home with an extra bedroom in this analysis. On average, you will also get a significantly bigger home, but the subject property in Fort Collins is a bit larger than our median figures were.

Now, lets look at what this means for your cash flow. With the same assumptions:

Purchase Price: $345,000

Loan Amount: $258,750

Debt Service – 30-Year Fixed at 4.5%: $1,311.05

30% Estimated Expenses on a Gross Rent Amount of $1,939: $581.70/Month

Cash Flow: $46.25/Month

This cash flow assumes you have all your maintenance expenses paid including management, property taxes and insurance. Not bad for a completely hands off investment. Are you going to get the same appreciation though?

My OPINION would be no. But, I am bullish on Greeley. What I am not bullish on, is their economy is not NEARLY diversified as Fort Collins is. It is heavy Oil and Gas and right now Oil and Gas is getting crushed. Lets hope Greeley does well through the coming months and years.

Overall, comparing Fort Collins to Greeley in terms of investing.

-Your dollar stretches farther in Greeley

-You can get similar rents for almost $30,000 less home

-The home you buy for $30,000 will be quite a bit newer, bigger, with an extra bedroom

-Greeley’s economy is not nearly as diversified as Fort Collins

-Unless you work in Greeley, plan on a 30-45 minute commute

-Fort Collins is a safer place for your capital, but you pay for it in cash flow

Thanks for reading as always. I’d love your input. ESPECIALLY if you’re in Greeley or considering investing in Greeley. What have I missed, overlooked, over assumed!

Have a great day, be safe and love one another!