Interest rates at HISTORIC lows, inventory at levels I have not seen, the Coronavirus wreaking havoc in and on the world, media and stock market and you’re sitting here wondering what in the hell you should do next. Well, I’m not going to tell you what’s the right move. What I am going to show you, based on the assumptions I will make (and outline), is what is the cost to you, to wait and buy a home.

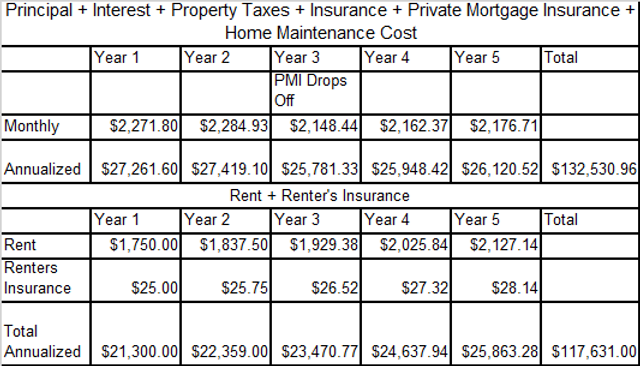

Assumptions that will follow throughout the following calculations:

-Current Rent – 3 Bedroom 2 Bathroom Condo – $1,750/Month

-Renter’s Insurance – $25/Month

-Rents Increase 5% Annually

-The Current Median Sales Price of a Home is $425,000

-Down payment of a 1st Time Home Buyer 6% or $25,500

-Current Interest Rate is 3% on a 30-Year Fixed Loan

-Private Mortgage Insurance $1,800/Year; Homeowners Insurance $1,500/Year; Property Taxes $2,000/Year; Home Maintenance Repairs $1,750/Year

-All Homeowner’s Expenses (Except Principal and Interest) increase at 3%/Year

-Home Appreciation is 5% Annually

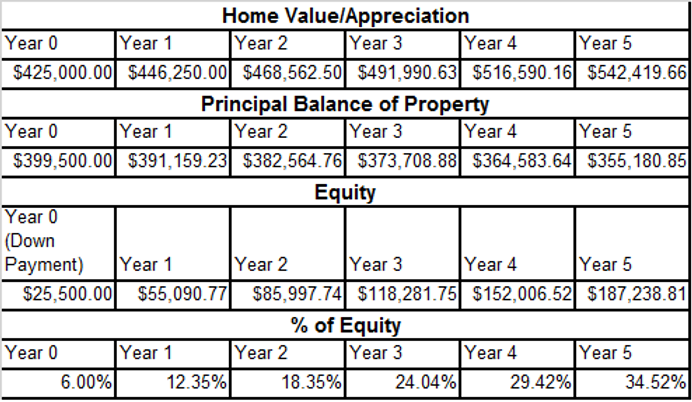

-Private Mortgage Insurance Drops off in Year 3. You’d need to get the home reappraised for this to happen, but due to the appreciation and principal pay down, your equity surpasses 20%.

-Interest Tax Deduction will NOT be Considered as You are Married and Will Take the Standard Deduction of $24,000

-Your Total Annual Income for Your Family is $80,000

-Your Income Increases at 3% Annually

-The Stock Market Produces a 10% Annual Return

Here is the comparison if you bought today versus renting over the next 5 Years:

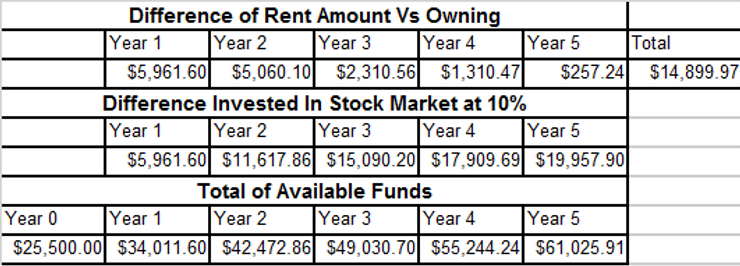

So, as you can see, you would SAVE money over the next 5 years if you rented versus being a homeowner. Almost $15,000 saved. Not only did you save, but you are a good steward of your finances and at the end of each year, you’ve invested the full amount into the stock market, receiving a 10% annual return. Here is the breakdown:

But is that the whole story? I don’t believe it is fair to say that only the HARD costs are what make up the difference. One of the BENEFITS of having that annual homeowners maintenance of $1,750 (annual estimate) is that YOU are getting the benefit of those dollars being put into your property. If you think that painting the exterior of your home may add value, you get the benefit of that value. Likewise, if you DON’T replace the furnace filter or clean your toilets, ovens and are a hoarder, well the value of your home may decrease as well.

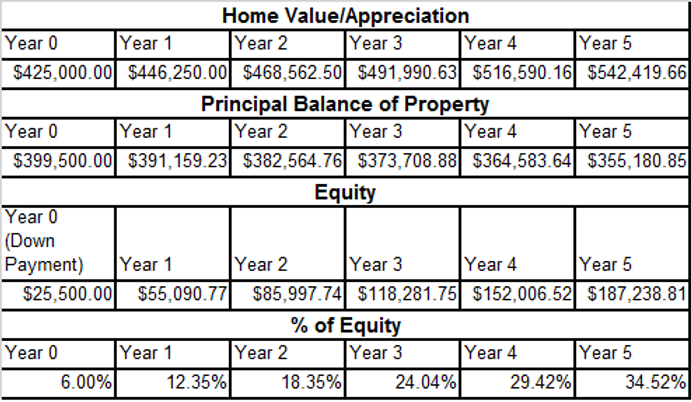

A portion of your mortgage payment is “Principal”, meaning that some of the dollars you are spending each month goes towards reducing your principal balance. This is like a built in savings account. Forced savings.

Finally, real estate historically, has appreciated. In Fort Collins, including the 2008-2009 recession, appreciated on average around 5%. As a homeowner, you get the benefit of your property appreciating with the market. Here is the breakdown of your EQUITY if you bought a home over the next 5 years.

WOW! Talk about amazing! Albert Einstein reportedly said it. “Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.” This is in full effect on the appreciation of your real estate. I do want to be fair here and say that his equity number is a little inflated. If you sell your house there are costs associated with selling a home (realtor fees, title fees, closing fees etc.), so the actual equity would be shaved off by about 8%.

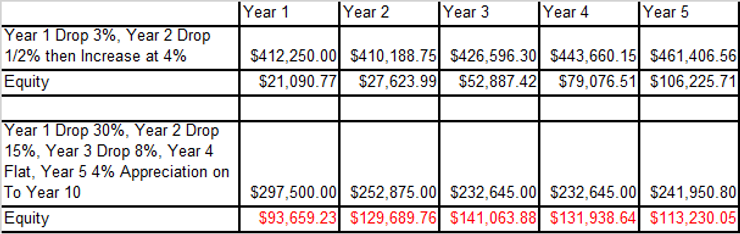

Okay, so I know that the market does not always react the same every year, on the year. There could be a down year or two. That is also true of the stock market. Sheesh, take the last 2 weeks if you don’t think that could happen. That being said, lets look at some different examples of how the market could react.

Look at some different AVERAGE appreciating markets. A couple examples below appreciate less than our current 5% assumption and one that is during a rockin time period and averages 6% appreciation over 5 years. Here it is:

Give me any 3 of those scenarios and I’ll take it.

But hey, lets be real. Real Estate has down years, ask anyone in Vegas. Below are two examples of buying in the middle or at the beginning of a recession. The top example is what Fort Collins roughly did during the recession and the bottom example is not quite Las Vegas, but a pretty dramatic housing market crash.

If we had to go through another “housing crash” like we did in Fort Collins, you’d still have quite a bit of equity in the home at the end of 5 years. Your initial $25,500 has almost quadrupled. BUT, if we ended up going through a Las Vegas HOUSING CRASHHHHH, then, yes it is going to be a long tough slog up the hill to regain your equity in your home, if ever. That’s why so many people decided to just walk away from their homes. They were so upside down that every dollar they were paying down, they were losing more dollars to the crashing housing prices. It’s a real possibility though. But hopefully we never see that again.

Why am I writing this article right now? Well, because interest rates really piqued my interest on how “affordable” it is to buy right now. I just locked in a refinance on my house at a 3% 30-year fixed rate. I thought when I bought my home in 2013 and had a rate of 3.25%, that I’d never see that again. I’m not sure if anyone thought we’d see those rates again. Well, they’re here. So, what if you wait? What could happen.

Below is a comparison to see if you waited one year, still put about 6% down on the new median price home (which appreciated 5%).

Who knows what interest rates are going to do. You know the one thing I can tell you… They are going to change. Maybe for your benefit if you waited. But, even waiting for the one year would add a little over to $100/month to your payment due to the increased price at the 3% interest rate you are now buying at today. It is pretty amazing to see what each percentage point does to your payment.

Okay, so we’ve seen that it “costs” less in today’s market to rent than to own in hard dollars. But what are the ancillary “costs” of NOT buying today?

A. Each dollar put towards rent is lost. In the first 5 years, about 33% of every dollar (considering ALL costs PITI, PMI, Home Maintenance) goes towards principal.

B. Every year you wait, (if you live in Fort Collins), you are not leveraging real estate’s appreciation of 5%. That is $117,420 of appreciation missed or $23,480 on average every year.

C. The percent of your income it takes to afford owning a home actually decrease each year, whereas the percent of your income it takes to rent (due to your pesky landlord increasing rents 5% every year) increases.

D. Future ability to take loans out on your home (I’m not a huge fan as of right now) HELOCs, from the appreciation and principal you’ve paid down.

Risks/Downsides of Owning a Home

I don’t think it would be fair to outline some of the risks owning a home:

-Another housing crash

-Your neighbor trashes his house… and well, that will negatively impact your property value

-Your furnace goes out… better be ready to fork out $2,500

-You’ve financed your home with an Adjustable Rate Mortgage (ARM) and after the 7 years, it adjusts… up 2% to 5%, then again the next year… 2%, now to 7%. It could happen.

-Your foundation starts to have issues. That HELOC will come in handy, because that’s going to be a big ticket repair

-Housing prices drop and you could have bought the same house next year for 5% less than you just bought your home for

-Moving flexibility. Real estate is not liquid and some times, it takes a long time to sell. If you have a new job opportunity but need to sell your home first, that could take some time and cost you some $$$s.

Ultimately, the decision on renting vs buying has to come down to what your comfort level is and also personal circumstances. I am a real estate agent, investor and property manager so I am clearly biased on what I feel the right decision is. I TRIED to be a neutral as I could be when looking at the costs of owning versus renting. The TRUE costs of owning versus renting (aka why I added the home maintenance expense).

Home ownership has always been a path towards creating familial wealth. It seems, these days, that flexibility and the ability to rent and then move is pretty popular for people under 30. Also that it is expensive to buy a home without the help of mom or dad on the first home. I also think that with intentional saving and cost savings, everyone can, within one year save enough to buy a home. Just because I used 6% to put down doesn’t mean I didn’t put 4% down on the house I bought in 2013 *wink wink*. There are programs out there to help assist you in buying your first home. Just make sure it is the RIGHT decision for you and your family.

Please, as always, pick apart my analysis. Tear me apart with what I missed. I love the discussion and welcome the dialogue. Thank you for reading!