The king of all Return on Investment (ROI) calculations. Forecasting your real estate investment is both an art and a science. Investing in single family homes and calculating IRR may be a little overkill. However, when investing in duplexes/triplexes and fourplexes, this may be a little more relevant. Lets dive in. Internal Rate of Return is the annualized rate of return of all the inflows and outflows of money with regards to the present value of money.

Which do you think is worth more; if I were to give you a dollar today or if I gave you a dollar a year from now? My greedy side would say take it now! That way I can spend it. However, my investor side would take that dollar and invest it. At the end of the year I may have a dollar and five cents. Short answer, a dollar today is worth more than a dollar tomorrow aka the present value of money. This is crucial information, considering that when calculating IRR, your return rate will be based off the net cash outflows and inflows and will be adjusted for the present value.

While calculators can do this calculation for us, it is good to know the theory behind it. IRR typically looks at 3, 5, 7 and 10 year “holds” on a property. Being an investor, you are looking for the best return for your money. If real estate is your choice, you will want to know the rate of return for buying, holding, and disposing of an asset over different lengths of time. It does not mean that at the end of year 5 or 7 you HAVE to sell. However, it does mean that if you were to sell, you will know what type of return your asset produced, as long as your cash flows and sales price match your estimations.

What is IRR?

The IRR looks at the total cost going into the property, Year 0. It then looks at the NET cash inflows or outflows (capital improvements must be included here) during the next 3, 5, or 7+ years. The final number is your sales price plus that year’s cash flows. Like a blender, it mixes the numbers up, and spits out a rate of return adjusting for the present value of money. BOOM!

Excel provides models and calculations that allow you to do these calculations very easily.

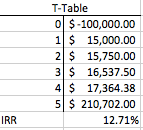

Let’s look at an example: Here you are purchasing a property for $400,000 with 25% down and holding it for 5 years. Rents and properties are increasing at 5% annually.

What this T-Table tells you is that if you invest your $100,000 today and dispose of it in 5 years you can expect an annualized return of 12.71%.

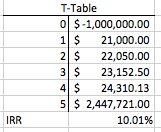

Below, is the same 5-year hold, but with $1,000,000 invested initially.

Which investment is better?

Personally, if I had $1,000,000 to invest, I would go with the option that returns 10% rather than needing to find 10 properties that have a similar 12.7% return. That’s just my personal preference. If you think you can find 10 properties or know of 10 properties that match those estimates of 12.7%, well you’d be nuts not to take the 12.7% IRR.

More than Just Numbers

When you begin to look at an investment property you start sizing it up. You look at the price of the property, financials, condition, market, and neighborhood statistics, you put on your mad scientist coat and start playing with numbers. Is the rent going to increase at 5% a year or 3% per year? Is the market appreciating, stagnant, or decreasing? How much capital improvements does this property need??

Whether or not you INTEND on selling the property, it is critically important that you calculate the what ifs. Circumstances change. You may buy a property for the purpose of cash flow, but what if the area is falling apart and you have to sell it in year 3? All that cash flow may NOT matter if you end up taking a bath on the sale .

Expectations

If you are going to be working with private money and private lenders, they will want to see these calculations, as well as look at the assumptions you are making and why you are making them. Bringing these types of analysis to an investor or potential partner will be expected.

Running these calculations will FORCE you to look hard at the asset and if it truly is a good purchase. IRR is the return calculation that holds the most weight. It takes ALL of the calculations and assumptions made on a property and puts them to work. It then gives you an annualized rate of return in today’s dollars. The internal rate of return truly is the granddaddy of them all .